Silver is certainly going through a turbulent period. After reaching all time highs of $120/oz in early 2026, it fell nearly 30% (the biggest drop in 40 years), eventually stabilizing and clawing back that lost ground to around $80/oz.

Had any of us predicted $100/oz silver one year ago, or even $80/oz, you would have been labeled optimistic or even delusional. Yet here we are today. Silver has taken on a life of its own, stepping out from the shadows of gold. It’s cheap. It’s tied to the dollar’s decline. It’s volatile. Everything speculators and traders enjoy in the marketplace.

So what has changed? The answer is simple: nothing. Silver is still tied to the dollar versus gold battle. Tied to global insecurity. Tied to rising shortages. Tied to industrial demand.

These forces don’t simply disappear after a sharp pullback, and in fact, this may prove to be a very healthy one.

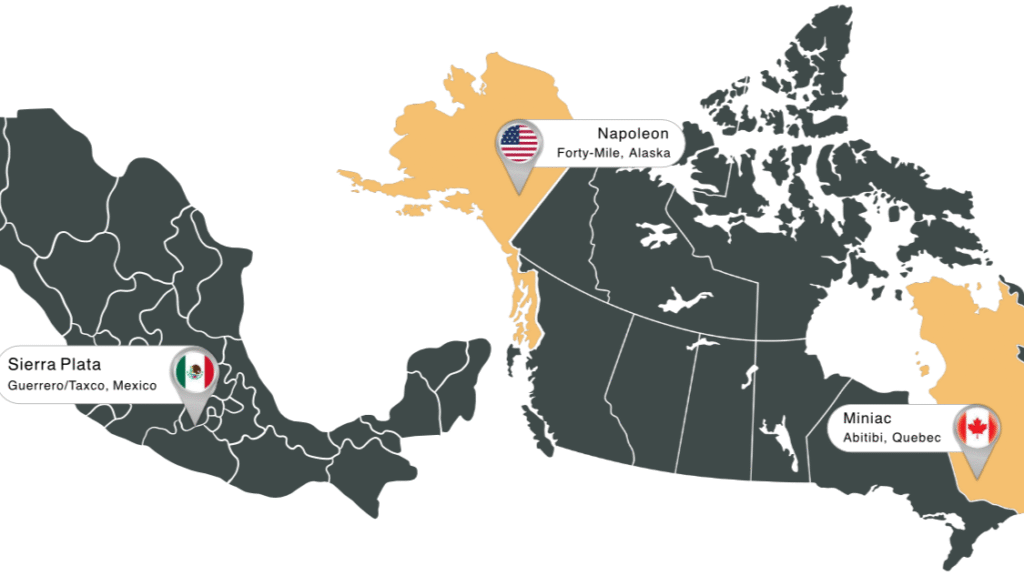

Today’s article focuses on J2 Metals, a new player in the silver exploration space with a very interesting acquisition. The company has just completed a $3.5M CAD raise and is now boots on the ground. Trading at almost cash to market cap!!

Where did they go?

Mexico. A country synonymous with silver. In fact, it is the single largest producer of silver in the world, accounting for approximately 25% of global supply. Known for outrageous grades and world class districts, Mexico produced over 200 Moz of silver in 2023.

The project is called Sierra Plata, located in the Zacualpan–Taxco District, one of Mexico’s most established silver producing regions. It is part of the Mexican epithermal belt that crosses the country.

There are several aspects of this property that stand out.

- J2 Metals optioned the project from Impact Silver, a known producer in Mexico with a nearby Zacualpan mine that has been in operation for 18 years. This is a fantastic partner for J2 and one that can help guide the company toward production.

- The project is surrounded by major neighbors, including Grupo Mexico and Pantera Silver.

- Five past producing silver mines across the property with high grade grab samples (414 g/t Ag 0.44 g/t Au >1% Sb)

- Widespread argillic alteration is present, the classic “smoke” of a potential epithermal system, supported by elevated mercury, antimony, and arsenic values.

- Regional mineralizing structures run across the project area, a critical feature for epithermal systems as they act as pathways for mineralizing fluids.

Mangement matters.

Thomas Lamb , CEO of J2 Metals, is also the CEO of Myriad Uranium, a US based uranium exploration company that is up 55% over the past six months. This is a proven management team that has delivered value and made shareholders money in the past.

As part of this acquisition, J2 has appointed Simon Clarke, who brings an equally impressive track record of creating shareholder value. Simon has served as CEO of American Lithium, M2 Cobalt, and Osum Oil Sands, and currently serves as CEO of American Critical Minerals Corp. M2 Cobalt was acquired by Jervois Global in 2019, while Osum Oil Sands was acquired by Waterous Energy Fund in 2021.

Northern Abitbi VMS Project

The Miniac Project is an early stage polymetallic VMS and intrusion related gold project located in the northern Abitibi. It is 100% owned by J2 and surrounded by multiple well known gold deposits, including Bouquet-Larondelle at approximately 25 Moz, Horne-Quemont at roughly 17.5 Moz, and Windfall at around 5 Moz. In total, there are an impressive ~65 Moz of gold deposits in the surrounding area.

Historic drilling targeted a large EM anomaly with a 2 by 4 km strike length and returned several interesting historic results:

- 2.06 g/t Au over 5.5m

- 1.37 g/t Au over 4.0m

- 4.80 g/t Au over 0.60m

- 1.05 g/t Au 0.16% Zn over 4.65m

This is another compelling project and one much closer to home for J2, representing significant exploration upside in a major district, a common thread across J2’s portfolio.

Important Information

J2 Metals intends to raise an additional C$1.5 million in flow-through to further exploration on their Canadian properties. For more information visit https://j2metals.ca/ or find the companies filings on Sedar+

The company is traded on the TSXV under ticker symbol JTWO and on FRA under ticker OO1

Disclaimer* J2 Metals has not paid for the production of this article. This article is not advise to buy any stock. Always do your own research.