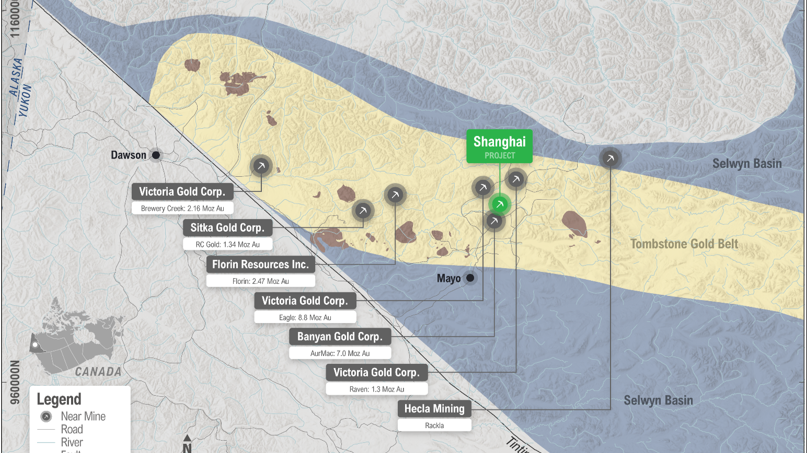

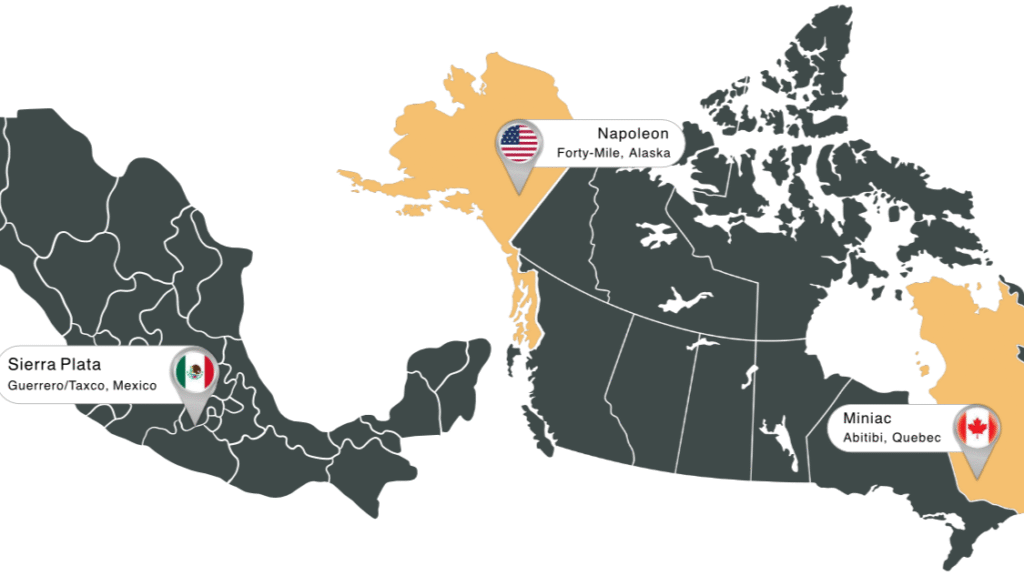

T2 Metals announced this morning a transformative acquisition of the Shanghai gold-silver project from renowned explorer Shawn Ryan. The project is located 12 km west of Hecla Mining’s Keno Hill silver mine, and midway between the AurMac, Eagle, and Raven intrusion-related deposits, which collectively total around 14 million ounces of gold.

Notable Names & Projects exploring in the Tombstone Gold Belt

- Sitka Gold Corp – RC 2.8Moz Gold

- Florin Resources Inc – Florin 2.47Moz Gold

- Banyan Gold Corp – AurMac 7.0Moz Gold

- Hecla Mining – Keno Hill Mine – 2.8Moz Silver 2024 Production

- Snowline Gold – Rogue 8Moz Gold

Shanghai Project

With no modern drilling, this project has plenty of untested upside potential. As part of the acquisition, T2 will have an eligible Class 3 permit Class 3 Quartz Mining Land Use permit, which enables drilling, road construction, and installation of a camp if required. The plan moving forward propsed by T2 is additional surface sampling and local geophysics to better refine and prioritise target areas, followed by drilling during 2026. High gold, silver, antimony, and bismuth in soil samples provide immediate targets. Gold values in soil up to 6.1 g/t Au;

Geological background

The Tombstone Gold Belt, a component of the larger Tintina Gold Province, is a highly prospective metallogenic province in the Yukon, with a range of well-known and emerging gold discoveries. The belt is characterized by a suite of mid-Cretaceous, reduced, felsic intrusions known as the Tombstone Plutonic Suite. These intrusive bodies and the surrounding host rocks have created conditions for the formation of numerous Intrusion-Related Gold Systems (IRGS). Exploration efforts have identified multiple mineralized corridors with gold hosted in sheeted quartz veins and disseminated mineralization within both the intrusive bodies and the hornfelsed country rocks.

Gold mineralization in the Tombstone Gold Belt is typically associated with a distinctive multi-element signature that includes bismuth, tellurium, and tungsten, along with arsenic and antimony. Gold-bearing fluids exsolved from cooling intrusions and preferentially deposited gold in brittle, structurally controlled environments. Both high-grade, structurally-controlled vein systems and lower-grade, bulk-tonnage deposits are known. The region hosts numerous significant deposits and is the site of recent discoveries by companies such as Snowline Gold Corp., Banyan Gold Corp. and Sitka Gold Corp.

Shawn Ryan’s expertise and competence to guide T2

Shawn Ryan a Yukon explorer, placed his first claims at Shanghai in 2004. A wide range of multi-million-ounce deposits have been found and developed in the Tombstone Gold Belt since its initial staking rush. As part of the acquisition, Shawn Ryan has agreed to join the board of T2 and contribute his knowledge to help guide the company to make a discovery at Shanghai

“We have worked hard to identify high potential gold projects to augment our existing portfolio, and are very pleased to have secured Shanghai in one of North America’s hottest gold exploration addresses. The project has been held by Shawn Ryan for over 20 years, during which time major gold projects have been discovered on the property boundaries.

New investment by a range of explorers in the Tombstone Gold Belt is progressively revealing significant gold deposits. We are very pleased to join the search, supported by one of the Yukon’s most successful explorers in Shawn Ryan.”

Mark Saxon, CEO of T2 Metals Corp.

The Figures

Subject to receipt of TSXV approval of the Option Agreement, T2 Metals will have the option to acquire a 100% undivided interest in the Shanghai project, for a total consideration of $500,000 in cash and 3,000,000 common shares of T2 Metals to be paid to the Optionor in incremental amounts over a seven-year period, which may be accelerated at the discretion of T2 Metals. An initial cash payment of $50,000 and an initial payment of 300,000 common shares in T2 Metals will be made following TSXV acceptance of the Transaction. All shares issued under the Option Agreement will be subject to a four-month hold period from the date of issuance in accordance with applicable securities laws.

In order to exercise the Option, T2 Metals is also required to incur exploration expenditures on the Shanghai project totalling a minimum of $1,800,000 over six years, including $100,000 by November 15, 2026. Upon commencement of commercial production on the Shanghai project, the Optionor will retain a 2% net smelter return royalty on the Property with 1% purchasable by T2 Metals for the cash payment of $1,000,000 to the Optionor

For more information on the #Shanghai project and on the company, visit their website at https://t2metals.com/ or contact Mark Saxon

Disclaimer* Paid media, Not financial advice