Disclaimer: Paid media. Not financial advice; always do your own research. Information may be incorrect or misleading.

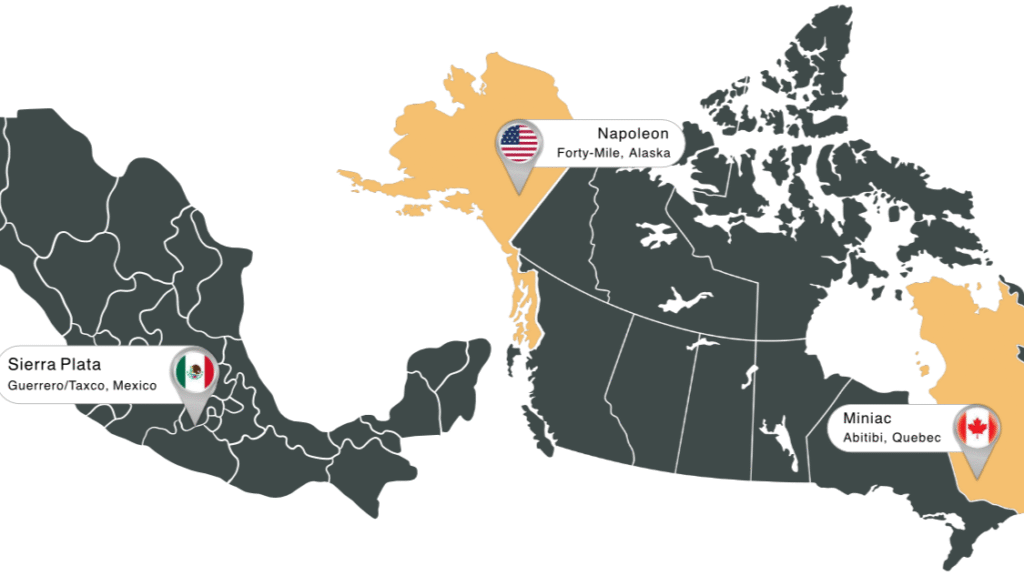

Bonterra Resources Inc. is a Canadian gold exploration company with a portfolio of advanced exploration assets centered around a milling facility in Quebec, Canada. The company trades on the TSX-V under the ticker symbol BTR, on the OTC under BONXF

Bonterra Resources Inc. focuses on the northeastern part of the Abitibi Greenstone Belt, an area recognized for producing over 200 million ounces of gold in the entire Abitibi region. The company aims to capitalize on this opportunity through a two-pronged strategy.

Joint Venture with GOLD FIELDS

Originally joint-ventured with Minière Osisko / Osisko Mining , Bonterra has welcomed the South African miner, Gold Fields, following the acquisition. Gold Fields has acquired the Windfall Deposit, which is located just north of the joint venture permits. This deposit boasts an impressive resource of 4.1 million ounces at 11.40 g/t Au (Measured and Indicated) and 3.3 million ounces at 8.40 g/t Au (Inferred). This is one of the largest gold deposits in Canada, with an exceptional grade of 8-11 g/t Au. The joint venture is focused immediately south of Windfall, where similar geological conditions and predefined resources present significant exploration upside alongside Gold Fields. Gold Fields is required to spend C$30 million on expenditures to earn a 70% interest in the project, as well as pay Bonterra C$5.0 million upfront.

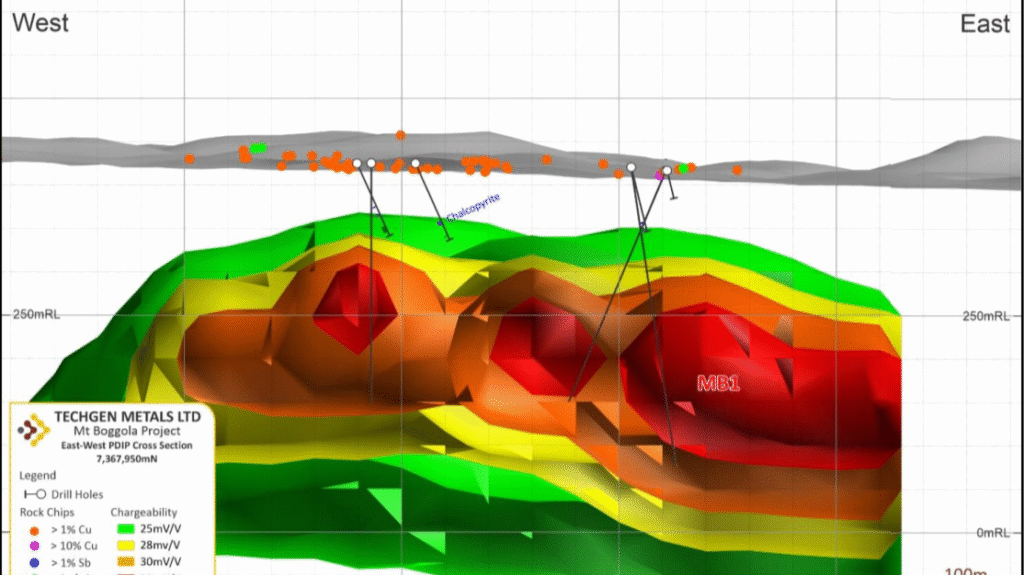

To date, 65,000 meters have been drilled, with 36,946 meters drilled at the Moss target, located just 5 km southwest of the Windfall Gold Deposit. In H2 2025, a 15,000-meter drill program is planned to target various locations to uncover the ultra-high-grade Lynx-style mineralization found at Windfall.

On the joint venture property, two resources are notable: the Barry Deposit, which hosts a resource of 689,000 ounces at 4.21 g/t Au (Measured and Indicated), alongside an additional resource of 689,000 ounces at 4.89 g/t Au (Inferred). The Gladiator Deposit contains 391,000 ounces at 8.61 g/t Au (Measured and Indicated) and an additional 989,000 ounces at 7.37 g/t Au. A mining lease at Barry permits both open-pit and underground extraction, allowing for the production of up to 1.2 million tonnes of ore.

In total, the joint venture has resources of 2.75 million ounces.

Understanding the potential value for Bonterra lies in the geological similarities along strike, with comparable faults and features hosting ultra-high-grade gold, similar to what is observed at Windfall. This isn’t merely a nearology play, but rather a geology-based approach aimed at unlocking value for Bonterra.

Desmaraisville Project 100% owned

Bonterra also fully owns the Desmaraisville Project, located 100 km north of the Phoenix joint venture. This project has a smaller resource of 160,000 ounces at 5.58 g/t Au (Measured and Indicated) and 104,000 ounces at 5.31 g/t Au (Inferred) on the Bachelor-Moroy Deposit. The processing plant on site can unlock any significant gold deposit in the area. The Bachelor complex also features an assay lab capable of handling ~6,000 assays per month, as well as three camps, two main roads, and several core shacks. Bonterra has an active mining lease with permits to extract up to 2M tonnes of ore. With great infrastructure in place, connected by road nearby to new Hydroelectric infrastructure and water sources not far away, this is a great starting point for the company.

Over the past couple of years, the company has drilled several high-grade intersections at the Desmaraisville project, underpinned by the 100% owned Bachelor Mill Complex situated just north of it. Once operational, this mill produced 350,000 ounces of historical gold output from the Bachelor Gold Mine. Bonterra aims to expand the mill’s capacity from 800 tons per day (tpd) to 1,800 tpd to support future mining activities. The complex has seen C$100 million spent, a figure Bonterra is likely to leverage.

Next Steps to Watch For

- Bonterra is planning a drill program of 10,000 to 12,000 meters at the Desmaraisville project, expected to be completed by year-end.

- Additionally, a 15,000-meter drill program is set for the Phoenix joint venture with Gold Fields.

Summary

Bonterra has secured gold ounces supported by a gold mill currently under care and maintenance, with a major gold producer, Gold Fields, funding the exploration at Phoenix. This contributes substantial value for shareholders. With strategic backing, the plan is straightforward: develop gold resources, advance them with a major producer, and maintain drilling activities at its fully owned project, all while planning to utilize the gold mill in this promising gold district.